THE CURRENT MARKET - THE HARDEST IT HAS EVER BEEN

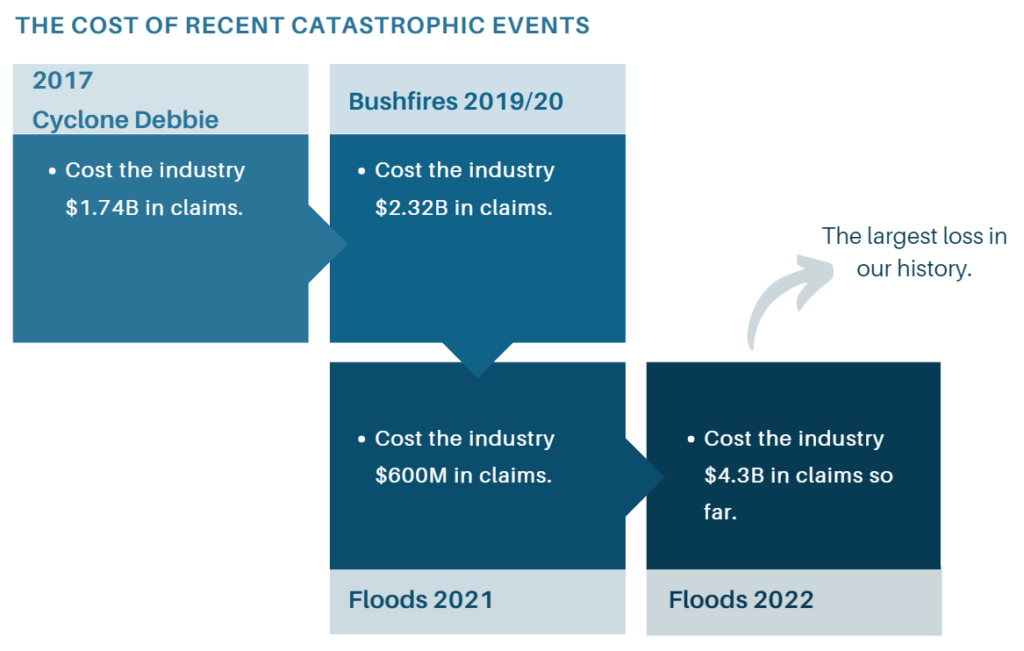

Traditionally, the insurance market has been cyclical and we saw premiums rise and fall over a 7-10 year period. However, as a result of the ongoing catastrophes in the last five years (outlined in the table below), alongside low interest rates, high inflation, and supply chain issues the market has been faced with unprecedented times and the hardest insurance market there has ever been. Clubs are being faced with significant premium increases and reduction in cover by insurers in order for them to rectify historically unpredictable results. It is of our opinion that this increase is the new benchmark and premiums are unlikely to fluctuate drastically in future but rather rise and fall by 5-10% around the ‘new normal’.

In order to manage the increase in premiums and increase your businesses appeal to insurers it is important now more than ever to have a solid risk management plan in place.

WHAT YOU CAN EXPECT FROM INSURERS

- Recent floods will ensure rates will continue to go up.

- Your insurer may reduce their capacity (few insurers will offer 100% capacity now).

- Conditions will be imposed – larger excess on inherent risks like storm, flood, cyclone etc. Locations in flood, bushfire and cyclone areas may not be able to get cover.

- Risk management will be scrutinised and become compulsory. You MUST demonstrate your risk management framework.

- Insurer appetites will change (it has nearly become a monthly occurrence).

what you need to do - it's all about managing your risk

NON-NEGOTIABLE

- Asset valuations (your D&O policy does not cover you if you get this wrong). Covid has dramatically increased building costs.

- If you have asbestos then you must have an Asbestos Management Plan and Register. This is a legal requirement.

- If you have aluminium composite panelling, and are unsure whether it’s flammable, arrange for a sample to be tested.

- Risk management (make sure your broker is asking for this. If not, give it to them anyway):

- Annual infrared scan of electrical circuits;

- Sprinkler / hydrant flow tests;

- Frequent cleaning of range hood filter and kitchen canopies;

- Servicing of fire protection equipment in accordance with Australian standards;

- Box gutters and roofing in general – regular maintenance;

- Contractor management controls;

- Preventative maintenance plan;

- Emergency response plan with liquid damage plan;

- Documented cash handling procedures;

- Formalised hot works procedures;

- General housekeeping;

- Insulated sandwich panel inspection / management;

- Fire impairment procedures.

In addition, it is important to be aware that clubs present a unique insurance risk that not all insurance brokers understand. We highly recommend dealing with brokers that have a great deal of experience in this market and the ability to negotiate with insurance companies through competitive advantage achieved through having larger portfolios of club business.

CONSIDERATIONS

- Get chemical suppression systems in your kitchen cooking hoods (approx. $25k).

- Larger deductibles – show you are willing to take some risk yourself.

- Independent surveys & address issues:

- Property

- Liability

- Alterations and additions – consider sprinklers.

- Outdoor gaming – can this be shut off during violent storms?

- Part of your due diligence on any amalgamation should include an insurance assessment – can we continue to insure the merged club?