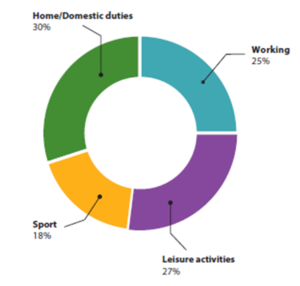

For employers, ensuring the financial stability of your employees is paramount, especially when unexpected circumstances, such as injuries or illnesses, arise. While workers’ compensation is a must have, 75% of Australians who were injured suffered the injury outside of work1. This highlights the importance of addressing broader health challenges that can impact your team.

Causes of injury;

Additionally, over 2.6 million Australians aged under 65 are living with physical disabilities2, including conditions like cancer, stroke, heart disease and depression, that in many cases will not be covered by Workers’ Compensation. So, how can individuals manage their living expenses if they’re injured outside of work or fall ill beyond their leave entitlements?

While the Australian Government provide a disability support pension, this is often a fraction of what employment earnings were and may reduce or not be eligible due to assets or income tests.

Businesses have a unique opportunity to support their employees by establishing a Group Salary Continuance (income protection) plan, which can replace up to 75% of an employee’s income if they are unable to work due to sickness, accident, or injury—potentially for the entirety of their working lives if needed.

Benefits for employees:

- Income Security: Cover living expenses and mortgage payments during illness or injury when leave is exhausted.

- Long-term Support: Monthly payments can potentially continue up to age 65 if the employee cannot return to work.

- Flexibility: Partial payments can apply if an employee is able to return to work on restricted hours

- Multiple Claims: Ability to claim on the policy multiple times for the same or different issues.

- Inclusive Coverage: Provides cover that individuals may not obtain individually due to existing health conditions.

Benefits for Businesses:

- Community Values: Demonstrate a commitment to community and family by supporting employees during challenging times.

- Employer of Choice: Gain a competitive edge in attracting and retaining top talent.

- Cost-Effective: Group policies are often more affordable than individual policies, providing significant cost savings for both the employee and the business, which generally is cheaper then the equivalent pay increase.

- Automatic Acceptance: Ensure access to coverage for those with family or medical history challenges, offering them protection they might not find elsewhere.

This is specialist cover through our partnership with Tempus Wealth, offering expertise and support for both your business and employees. Please don’t hesitate to contact us on (02) 9587 3500 or emailing theteam@wsib.com.au to explore how Group Salary Continuance can benefit your team.

- AIHW (2008) Australia’s Health 2008, Cat. no. AUS 99, Canberra

- http://www.abs.gov.au/ausstats/abs@.nsf/mf/4825.0.55.001/ accessed on 30 August 2012.