-

31/03/2025

Supporting Safer Workplaces

Employers Mutual have developed a range of posters on a variety of Workplace Health and Safety (WHS) topics to help improve health, safety and return to work outcomes in Australian workplaces.

Take advantage of their new posters – free and ready to use in your organisation today.

READ MORE -

31/03/2025

Occupational Noise and Audiometric Testing

There has been a recent change to the Workplace Health & Safety Regulation, effective 01st January 2024.

This is a very notable piece of legislation, as it talks to the need for Persons Conducting a Business or Undertaking (PCBU) to provide audiometric testing to their workforce.

READ MORE -

31/03/2025

Review of NSW WHS Laws

The 10th of June 2025 will mark 5 years since the NSW government introduced revised WHS legislation that prohibited insurance from indemnifying penalties imposed under that law.

READ MORE -

31/03/2025

How to spot five common impersonation scams

All scams involve a form of impersonation, but some disguises are more popular and effective than others. Here’s how you can spot five common types of impersonation scam and help keep your money protected.

See below on how to spot common impersonation scams.

READ MORE -

19/12/2024

How to avoid scammers

Scammers are constantly evolving their tactics to target small businesses. The federal government’s Scamwatch site is a great resource for understanding the latest scams and for reporting a new scam.

READ MORE -

19/12/2024

Return to Work Programs

As we enter into the festive season many businesses are starting to wind down operations and deservedly so after another busy year. However, Saunders Safety & Training have received a record number of enquiries pertaining to Return to Work Programs and just like the summer weather, things are heating up!

READ MORE -

17/12/2024

Utilising Insurance to Enhance Your Employee Benefits Program

Incorporating insurance options into your employee benefits program can significantly enhance the value and appeal of your organisation, positioning it as an Employer of Choice while improving employee retention and satisfaction.

READ MORE -

30/09/2024

Changes to use of Silica in the Workplace

New safety requirements for work involving the processing of Crystaline Silica Substances (CSS) containing at least 1% silica apply from 01 September 2024 (NSW). These updates see the requirement for businesses to risk rate the processing of Crystaline Silica Substances, and subsequently develop Control Plans, report on Workplace Exposure Standard exceedances, and undertake specific training for staff and contractors. For more information, contact Saunders Safety & Training today.

READ MORE -

26/09/2024

Lessons from Triage - Labour Hire

A standard question asked when a Public/Products Liability policy is placed is whether the insured engaged labour hire personnel and/or contractors or sub-contractors.

A situation that comes up regularly is with what I will call internal labour hire.

READ MORE -

26/09/2024

Cyber awareness: Wrongful use of licensed music

Sony Music sues Marriott over hundreds of songs used in social media ads. It is important to ensure that they have the legal right to use any third-party IP included in their social media posts.

READ MORE -

26/09/2024

October is National Safe Work Month!

The 2024 edition of Safe Work Month is ‘Health & Safety is everyone’s business’ encapsulating the growing need for a healthy and safe workplace environment, and the potential positive impacts and benefits to businesses who buy in to these strategies. Each of the 4 weeks brings with it a different topic, including WHS fundamentals, Psychosocial Hazards, Risk Management fundamentals and Musculoskeletal injuries.

READ MORE -

28/06/2024

Workers Compensation Premiums creating a financial pinch?

As we move closer to another end of financial year where the majority of employers renew their Workers Compensation policies, it’s timely to remind businesses of the changes coming especially specific to industry risk rates.

READ MORE -

28/06/2024

Data breach incidents on the rise in Australia

Australia is grappling with a significant increase in data breaches, with 1.8 million user accounts compromised during Q1 2024.

READ MORE -

5/04/2024

Significant changes incoming for NSW & VIC compensation schemes

Employers and businesses who operate in New South Wales and Victoria need to be aware of some quite significant changes across both schemes in the lead up to this 30 June 2024.

READ MORE -

5/04/2024

Are you properly protecting your home from water damage? See these tips

While most homeowners focus on protecting their homes against theft and fire through locking devices, alarm systems and smoke detectors, they tend to ignore another major threat to their homes – internal water leak damage. Homeowners of a property with a history of water damage could face difficulty obtaining insurance, or experience higher premiums.

To minimise the chance of internal water leak damage, here are some proactive steps you can take to protect your home.

READ MORE -

5/04/2024

How does your cyber security match up?

One of the primary risk management issues currently being faced by many of our clients is cyber security particularly in respect of personally identifiable information (PII) and privacy. The legislative landscape around PII and privacy has been subject to rapid and significant reform in recent years. The last update to privacy legislation in 2022 significantly increased penalties for repeated or serious breaches of privacy legislation by companies.

READ MORE -

18/12/2023

Business Interruption Insurance during Bushfire Season

The past few years of natural disasters, from bushfires to floods, have reminded many business owners about the importance of business interruption (BI) insurance.

It’s been the difference between keeping their doors open or closing shop for good for some businesses. We’ll delve into who needs BI insurance, what it covers and how it works.

READ MORE -

15/12/2023

Reviewing your Return to Work Programs

As we enter into the festive season many businesses are starting to wind down operations and deservedly so after another busy year.

However, Saunders Safety & Training have received a record number of enquiries pertaining to Return to Work Programs and just like the summer weather, things are heating up!

READ MORE -

15/12/2023

Safeguarding employees financial wellbeing, even when they are not at work

For employers, ensuring the financial stability of your employees is paramount, especially when unexpected circumstances, such as injuries or illnesses, arise. While workers’ compensation is a must have, 75% of Australians who were injured suffered the injury outside of work. This highlights the importance of addressing broader health challenges that can impact your team.

Click the link below for more information.

READ MORE -

10/10/2023

Fires caused by lithium batteries are on the rise.

In recent years, there has been a concerning increase in fires caused by lithium batteries. These incidents not only pose a danger to lives and property but also highlight the need for greater awareness and precautions when it comes to these common power sources.

Click the link below for more information.

READ MORE -

10/10/2023

Are you managing your asbestos risk in accordance with current legislation?

For a long time, there has been much attention placed on the very dangerous and ill affects Asbestos exposure can have on an individual and as a result, legislation now exists to maximise the safety of workers within a workplace. Are you managing your workplace asbestos risk effectively?

Click the link below for more information and how we can help.

READ MORE -

4/10/2023

How to prepare your business for an El Nino Summer

It’s official, an El Nino weather event has been declared by the BoM and with this, according to the Climate Council, comes warmer-than-usual temperatures and reduced rainfall. This combination not only heightens the risk of extreme heat but also elevates the danger of bushfires, particularly in southeastern regions. Therefore it is important to be extra diligent during these times.

Click the link below for some tips on how to prepare your business for an El Nino Summer.

READ MORE -

14/06/2023

Ten steps to help prevent a cyber attack in your business

The latest cybercrime statistics make for sobering reading, with a 75 per cent rise in ransomware attacks in the 2021/2022 financial year and up to 200,000 vulnerable routers in Australian homes and small businesses.

The Australian Cyber Security Centre’s (ACSC) most recent annual report states medium-sized businesses with between 20 and 199 employees are the most at risk of attack, with the average cost of an attack for a business of this size being $88,407.

Click the link to find out how you can minimise your risk.

READ MORE -

13/06/2023

How employment law changes could affect your small business

If you’re a small business owner, a good team is possibly your biggest asset, but it can be tricky to stay abreast of the rules around employing staff.

These rules changed again recently, following the passing of the Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022.

So, what’s new, and how could it affect your business?

Click the link to find out more.

READ MORE -

31/05/2023

Workers Compensation - Premium Rate increases released for NSW & Victoria

NSW – the premium rates for the Nominal Insurer workers compensation scheme will increase by an average of 8% for the 2023-24 financial year.

VIC – the average premium rate has increased to 1.8% from 1.272%, effective 1 July 2023.Click the link to find out more.

READ MORE -

24/03/2023

How does rising inflation affect Small Business and Personal insurance?

The rising inflation we’re experiencing now is affecting insurance in a number of ways. Materials commonly used to replace damaged properties, such as building items and even labour, are in short supply, driving up replacement costs. As a result, to avoid underinsurance, we recommend annual reviews of your sum insured.

Click the link to find out more.

READ MORE -

22/03/2023

Statutory Liability insurance - should transport companies have it?

Each year in Australia transport operators die or are injured doing their jobs. Should a serious compliance problem or an incident occur within your business, regulators suddenly may be looking to launch an Inquiry against your company, or even serve your business with papers to go to court. This is where Statutory Liability insurance comes in, to help reduce the financial burden in the event that this might occur.

Click the link to find out more.

READ MORE -

10/02/2023

AUDITSAVE

As widely promoted and warned on every news and media platform, due to Covid, other disaster relief payments issued by the government over the past 2 years, and the current property boom, the ATO have every intent to dramatically increase random and targeted Tax Audits, Reviews, and Investigations on salary wage earners, businesses, and SMSFs. With this in mind, a superior product and structure is now available, through us, to ensure more clients are protected.

Click the link to find out more.

READ MORE -

16/12/2022

Loss Time Injury Frequency Rate

SafeWork Australia has recently updated the data powering their Loss Time Injury Frequency Rate (LTIFR) calculator. This calculator is useful to employers to compare their WHS performance against their industry, and now includes 2020-2021 data to provide more accurate benchmarking capability.

Click the link to find out more.

READ MORE -

16/11/2022

Have you ever considered Premium Funding?

As a result of the current economic climate, we are seeing the cost of living continue to increase. From rises in interest rates to insurance premium increases, whichever way we look at it, cash flow is becoming more and more of an issue in many Australian businesses.

This is where Premium Funding comes in.

Click the link to find out more.

READ MORE -

6/10/2022

icare announces selection of claims service providers for the NSW Workers Compensation Scheme

icare recently announced a significant milestone in its program to improve NSW workers compensation with the selection of six Claims and Injury Management Service Providers to manage claims within the NSW Nominal Insurer Scheme.

Following a comprehensive tender process, icare has selected Allianz, DXC, Employers Mutual Limited (EML), Gallagher Bassett (GB), GIO and QBE to manage workers compensation claims for the NSW Nominal Insurer.

Click the link to find out more.

READ MORE -

6/10/2022

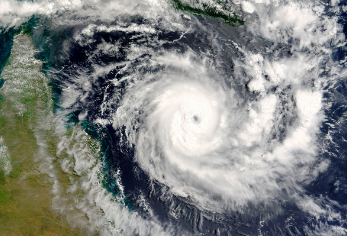

Is your home or building ready for a third consecutive La Nina?

It’s time to batten down the hatches and ensure your home or building is ready because the third consecutive La Nina is well and truly underway. There are several things you can do to help mitigate your risk during this period, one of the major ones being to ensure you have adequate cover.

Click the link to find out more.

READ MORE -

6/10/2022

WorkSafe Inspectorate activity increasing through Predictive Modelling

The NSW Insurance Regulator is collecting data from the Workers Compensation Scheme Agents to drive an increase in on-site safety inspections. Increased frequency of claims, nature and mechanism data, and events such as surgical intervention in first month of claim are being reviewed with plans to increase inspections by over 250%. Speak to WSIB today to discuss how our Workers Compensation division can assist in mitigating inspection risks.

Click the link to find out more.

READ MORE -

24/08/2022

Cyber and Breach of Privacy

If your organisation holds personal information that belongs to your clients, customers, suppliers and third parties then you could be a target for cyber hackers. If this information is accessed by hackers then there has been a notifiable data breach which has to be notified to the Office of the Australian Information Commissioner and to the affected individuals. The cost of providing this notification can be high and it can be an onerous task to notify individuals particularly when they are former clients you may have lost touch with. This is where cyber insurance comes into play as an important tool in managing this process.

Click the link to find out more.

READ MORE -

15/06/2022

iCare NSW - Premium update

iCare has recently made some updates which will impact premiums and LPR adjustment factors, all of which will come into effect as of 30th June 2022. Click the link below to learn more and find out what this means for your business.

Click the link to find out more.

READ MORE -

8/06/2022

Adequate Cyber security measures are law

Adequate Cyber security measures for the financial services industry are law. Reforms introduced as part of the Hayne royal commission mean that a failure to comply with certain AFS licensing obligations – including obligations relating to how cyber risks are addressed – may give rise to a civil penalty.

Click the link to find out more.

READ MORE -

2/06/2022

Insurance Market Update - Clubs

Traditionally, the insurance market has been cyclical and we saw premiums rise and fall over a 7-10 year period. However, as a result of the ongoing catastrophes in the last five years, alongside low interest rates, high inflation, and supply chain issues the market has been faced with unprecedented times and the hardest insurance market there has ever been.

Click the link to find out more.

READ MORE -

25/03/2022

Industries with the most Cyber breaches

Did you know that the Finance and the Legal, Accounting and Management services industries both sit within the top three positions when it comes to the highest amount of cyber breaches according to the OAIC?

Click the link to find out more.

READ MORE -

25/03/2022

NSW iCare Update

iCare launches open market tender for claims and injury management services and announced freezes on eligible employers moving between claim service providers.

Click the link to find out more.

READ MORE -

15/12/2021

Armed hold ups and workplace violence or aggression

As Christmas approaches, we regularly see an increase in the prevalence of armed hold ups and workplace violence or aggression.

Click the link to find out more.

READ MORE -

15/09/2021

iCare COVID Premium Impacts

iCare confirms that claims related to COVID-19 won’t impact premiums.

Click the link to find out more.

READ MORE -

15/09/2021

Legal Expenses Insurance

The justice system can be complex and expensive. Legal expenses insurance provides you with affordable access to legal advice and representation when you might otherwise be deterred from exercising your legal rights.

Click the link to find out more.

READ MORE -

14/07/2021

Combat anxiety with exercise

Physical exercise is key to reducing anxiety levels and it’s important now more than ever to pay attention to your mental health. The following article provides some tips to help get you started in easing symptoms of anxiety.

Click the link to find out more.

READ MORE -

9/07/2021

Cybercriminals targeting building & construction companies

In the past six months, there has been an increase in cybercriminals targeting builders and construction companies to conduct business email compromise (BEC) scams within Australia.

Click the link to find out more.

READ MORE -

9/07/2021

Cyber premiums on the rise

We are currently experiencing a rise in Cyber premiums, similar to that experienced with D&O cover. The following article explains why and what you can do to mitigate your risks.

Click the link to find out more.

READ MORE -

8/07/2021

Clean air. Clean Lungs.

Not all hazards in the workplace are visible… For example, breathing in dusts, gases, fumes and vapours at work can damage the lungs. Being exposed to these hazards can lead to conditions like asthma, or diseases like lung cancer, asbestosis, mesothelioma and chronic obstructive pulmonary disease.

Click the link to find out more.

READ MORE -

16/06/2021

VIC Legislation changes for Provisional Payments

An overview of the legislative changes regarding Provisional Payments for psychological injury can be found within this article.

Click the link to find out more.

READ MORE -

1/04/2021

Audit Insurance

The ATO definitely plans to be more active in 2021 and increase its audit activity. One of the ways you can manage your risk and prepare yourself for an ATO audit or review is through Audit Insurance.

Click the link to find out more.

READ MORE -

31/03/2021

Is Your Workplace too Noisy?

Did you know that as an employer, you are required to address noisy working environments by reviewing the sound levels, worker exposure times and providing hearing checks for those workers exposed to excessive noise levels?

Click the link to find out more.

READ MORE -

31/03/2021

Prestige Home Insurance

Is your family’s most valued possession covered with the level of prestige insurance it deserves?

Given we are still in bushfire, storm and flood season it is an important time to ensure your home and valuables are sufficiently protected.Click the link to find out more.

READ MORE -

26/03/2021

Prize Indemnity Insurance

Have you ever considered prize indemnity insurance?

By engaging in prize indemnity insurance, this gives you the ability to offer special contests and promotions with attractive prizes like cars, holidays, and even cash, while transferring the risk of the prize to an insurer.Click the link to find out more.

READ MORE -

26/03/2021

icare proposes NSW Workers Compensation premium rate increases

NSW Workers Compensation insurer (icare) has advised an expected premium increase of 2.9% at a Scheme level for 2021-2022, and a further 2.9% increase for 2022-2023. For employers within the Loss Prevention & Recovery (LPR) scheme, it is anticipated that there will be a 5% increase to the adjustment rates for 2021-2022, and that the ESI will remain and at 7.5%.

Click the link to find out more.

READ MORE -

9/12/2020

Important NSW Market Update

The new claims model introduced by iCare in 2018 has not delivered the ideal outcome. As a result, WSIB have been working with a number of parties to drive change and we are pleased to share that iCare have acknowledged the need for this change and have committed to a $20 million investment program to deliver short and long term updates to the current claims model.

Click the link to find out more.

READ MORE -

3/12/2020

Preparing for a Severe Storm

Storms cause significant damage throughout Australian communities, each year. However, you can take action before, during and after a storm to reduce the impact on your home or business.

Click the link to find out more.

READ MORE -

3/12/2020

Preparing for a Flood

Despite Australia’s dry terrain that is often affected by drought, significant floods occur in parts of Australia each year. These floods can cause extensive damage to both homes and businesses. However, you can take action before, during and after a flood to reduce the impact on your home or business.

Click the link to find out more.

READ MORE -

2/12/2020

Preparing for a Cyclone

Every year, Australia’s high-risk cyclone areas can expect an average of two to three cyclones to cross the coast during the November-April cyclone season. Combining strong winds, heavy rain and flying debris, cyclones can be devastating. However, you can take action before, during and after a cyclone to reduce the impact on your home or business.

Click the link to find out more.

READ MORE -

2/12/2020

Preparing for a Bushfire

The intensity and course of a bushfire can change rapidly and threaten the safety of homes and businesses alike. However, you can take action before, during and after a bushfire to reduce the impact on your home or business.

Click the link to find out more.

READ MORE -

25/11/2020

COVID-19 Business Interruption Test Case

You may have seen in the press recently the decision handed down in the NSW Court of Appeal in a test case run by the Insurance Council of Australia (ICA) and Australian Financial Complaints Authority (AFCA), with the court ruling in favour of the insureds. It found that the quarantine disease cover restriction in business interruption policies that referred to the now repealed Quarantine Act, does not exclude cover for listed human diseases under the Biosecurity Act 2015..

Click the link to find out what this means for you.

READ MORE -

30/09/2020

Personal Cyber Cover

Technology is playing a bigger role in families lives than ever before and with this, comes the increased exposure to inherent cyber risks that haven’t been faced before. This highlights the need for families and individuals to have cyber protection in place.

Click the link for further details.

READ MORE -

30/09/2020

Amendments to the WHS Act (NSW)

The Work Health and Safety Amendment (Review) Act 2020 passed in June 2020 by the NSW Parliament has enacted a number of changes to NSW WHS laws.

Click the link for further details.

READ MORE -

22/06/2020

Getting back to work; COVID-19 Safety Plan - Clubs & Pubs

The NSW government have prepared a document with relation to the re-opening of clubs and pubs which should be completed in consultation with your workers.

Click the link for further details and to download this form.

READ MORE -

9/06/2020

LEGISLATION CHANGES - WORKERS COMPENSATION ACT (1987)

A new section (19B) has been inserted in the Workers Compensation Act (1987) that now creates an automatic entitlement to compensation should a worker in prescribed employment contract Novel Coronavirus (COVID-19).

Click the link for further details and the full article.

READ MORE -

31/05/2020

Things to consider - Licensed venues

Around the country, many bars and licensed premises have started reopening to a restricted number of people.

As your patrons begin to return to your venue, it is important to make sure you are sticking to the rules required for all licensed premises regardless of a pandemic, otherwise a huge fine, or even worse, could be on its way.

Click the link to take a look at a few recent incidents to explore the most common issues that land licensed businesses in trouble.

READ MORE -

28/05/2020

Things to consider when restarting your equipment post COVID-19 shutdown

With COVID-19 unfortunately temporarily closing the doors of many businesses, there are some important things to consider when reopening and restarting your equipment. One of the key potential issues that we need to recognise is that there may be an increased risk of equipment failure when starting up equipment that has been non-operational for a period of time.

Please click to read more information on this and why these start-up failures may arise.

READ MORE -

1/05/2020

JobKeeper payment and impact on Workers Compensation in NSW

There have been many questions raised around how the Australian Government’s Jobkeeper payment which is designed to help keep Australians in jobs and support businesses affected by the significant economic impact caused by COVID-19 could potentially impact your Workers Compensation Premiums and your Injured Workers weekly entitlements.

Please click to read some important information released by SIRA yesterday and confirms our previous advice relating to the JobKeeper payment.

READ MORE -

20/04/2020

Workers Compensation Premium Relief

We have been in discussion with State & National Insurers, together with relevant regulatory authorities to seek, where possible, an amendment to Workers Compensation premiums under certain circumstances, to take into consideration the impact that COVID-19 has had on the Australian Workforce.

READ MORE -

20/04/2020

Cyber Security and Protection During a Pandemic

Instructing and empowering staff to work remotely has been a common way to encourage social distancing to minimise the spread of the virus. However, this comes with its own set of unique risks and exposures for your organisation. Remote work arrangements can have security implication and cyber-criminals may attempt to take advantage of this..

READ MORE -

26/03/2020

Pandemic Property Protection Advice

The COVID 19 Pandemic has thrown up many challenges to individuals and businesses alike, and social distancing procedures have forced many businesses to cease trading leaving their premises unoccupied or at the very least idle. If you find yourself in this situation we have prepared some practical advice on how to protect your assets during this period.

READ MORE -

24/03/2020

Workers Compensation & COVID-19

CORONAVIRUS (COVID 19) – ARE YOU LIABLE AND WHAT IMPACT WILL IT HAVE?

Many of you have already been in contact with us to enquire as to whether or not an employee who contracts Coronavirus in the workplace could constitute a compensable claim? The short answer is yes.

READ MORE -

21/02/2020

Claims Management Update

With the recent bush-fires, hail storms and general wild weather, our claims management department has understandably had a large influx of claims reported. Due to these recent events there has been a delay in the speed of service from all aspects of insurance claims.

READ MORE -

3/01/2020

Australian Bushfires - Potential Risk to Damaged Properties

As the bushfires continue to worsen across Australia, we want you to know that we are available if/when assistance is required. In the meantime, if your property has suffered damage please be aware of the potential risk which may be present.

READ MORE -

27/11/2019

SIRA announces Workers Compensation Review

The State Insurance Regulatory Authority (SIRA) has commissioned a thorough review of the current workers compensation scheme in NSW, primarily to review the performance of the nominal Insurer (icare) and its Agents (EML, Allianz & GIO).

READ MORE -

27/11/2019

Premium Updates for 2019-20

icare are currently in the process of implementing the changes that they have made to workers insurance premiums in NSW. You will shortly receive an email from icare which will invite you to renew your policy. Prior to submitting wage declarations, it is vitally important that you contact our premiums team who will further detail the changes, analyse the impact, and accuracy, and will also be able to provide you with live projections and forecasts if required.

READ MORE -

8/11/2019

Deadly Weapons Insurance.

Worldwide the occurrence of malicious attacks is on the rise. Recently a man yielding a knife threatened pedestrians in Sydney CBD after murdering a lady in a nearby hotel room and prior to this an assailant was arrested after wielding a chainsaw in a Melbourne Street. Have you ever considered if your place of business could be at threat of one of these attacks, or could your business be the location for one of these attacks?

READ MORE -

8/11/2019

Are you Cyber Secure?

When was the last time you thought about the cyber security within your business? Or when did you last review your in-house mitigation policies and procedures? Have you got a cyber disaster response plan in place? What would you do if your entire IT infrastructure was compromised?

READ MORE -

8/11/2019

Caution with Hire Vehicles

A recent appeal from the NSW Local Magistrates Court to the NSW Supreme Court modifies how claims are assessed for drivers who hire vehicles after a car accident where they may seek recovery.

READ MORE -

20/10/2019

PIAWE Regulation changes are here!

The PIAWE Regulation will change the way an injured workers pre-injury average weekly earnings (PIAWE) is calculated, and will come into effect for workers injured on or after Monday 21 October 2019.

READ MORE -

13/07/2018

New Mobile Camera Detection Laws in NSW

New technology will see speed camera style technology used to detect illegal mobile phone use, as part of a huge crackdown on NSW roads from July 1, 2018

READ MORE -

13/07/2018

Safework NSW - Are you at Risk?

Safework are out in force inspecting Return to Work Programs -are you sure your return to work Programs complies with the new SIRA Guidelines? It is important that every business is aware of their WHS obligations.

READ MORE -

13/07/2018

Mark Bouris reveals traits of struggling firms

With his TV series The Mentor now wrapped up, multimillionaire businessman Mark Bouris has shared some insights into the factors shared by all of the struggling businesses he sought to turn around.

READ MORE -

13/07/2018

5 Misconceptions About Insurance Exposures

5 Common Misconceptions About Insurance and Business Exposures; Workers Comp Insurance will cover me for a SafeWork investigation, Long time employees can be trusted and rarely engage in fraud, Employment obligations start the day that I hire someone…

READ MORE -

15/06/2018

Coal Mining Legislative Changes

Do you have workers on a Coal Mining Site?

Section 31 of the Act requires employers in the coal industry to obtain workers compensation insurance from an approved workers compensation company for their employees in that industry. Currently, the approved workers compensation company under the Act is Coal Mines Insurance.

The Act now includes a definition of employer in the coal industry to make it clear that any employer whose employees work in or about a coal mine is required to be insured with an approved workers compensation company with respect to those employees and their employment in or about a coal mine.

READ MORE -

11/05/2018

Everything Cyber

Your business, relies upon technology just to exist. From paying suppliers, to marketing your goods and liaising with clients, your bottom line relies upon your ability to communicate electronically.

So what happens if you can not access your data, IT infrastructure or the internet? As technology becomes more sophisticated, so do the threats we face.

READ MORE -

19/03/2018

Make your 2018 the best year Ever!

Looking back at 2017, have you achieved your goals? Is your business in a better place? How will 2018 be a better year?

This article provides 6 excellent tips on what to do to make 2018 your best year ever. Sometimes you need to ask tough questions to improve.

READ MORE -

19/03/2018

Southern Sydney Business Education Network

Southern Sydney Business Education Network (SSBEN) is a not for profit organisation based in Sutherland that has been assisting young people to make successful transitions from school to work, for over 10 years.

Warren Saunders are part of a Statewide Network of organisations building relationships to help achieve better educational outcomes for all young people. A very worthwhile cause that we are extremely proud to be part of.

READ MORE -

11/12/2017

2017 END OF YEAR NEWSLETTER

This year has seen some significant changes, not only to the insurance industry, but to our own company in itself. We have successfully launched new divisions, introduced new employees and tackled the changing landscapes of insurance in both the workers compensation space and general insurance division. Included in this newsletter are the articles relevant to these changes.

READ MORE -

2/11/2017

WSIB Charity Golf Day

The team at Warren Saunders would like to thank all of those who attended our Charity Golf Day. thanks to your generous support on the day we managed to raise $2,000 for the St George Cancer Care Centre.

READ MORE -

24/10/2017

2017 Supplier Golf Day

We would like to thank all of those who battled the weather to attend our annual golf day. Rain, hail or shine WSIB always enjoy a day out with our fellow staff and business associates

READ MORE -

9/10/2017

2018 Mandatory Reporting of Data Breaches

Until now, data breach reporting in Australia has been largely voluntary. While regulated entities have been legally obligated to take reasonable steps to maintain the security of personal information held, there has been no obligation to notify individuals if their personal information is compromised.

Finally though, after many years of stops and starts, the Privacy Amendment (Notifiable Data Breaches) Act 2017 (Cth) passed the Senate on 13 February 2017 and received assent on 22 February 2018.

READ MORE -

29/08/2017

Behind the Scenes at icare

This year has seen significant changes to the NSW Workers Insurance Landscape, with many of these changes still coming through from icare. Do you know where you and your business stand? Do you have the appropriate information to know whether these changes affect you and your business?

READ MORE -

29/08/2017

Government ESL Creates Client Concern

The recent decision by the New South Wales State Government to reinstate the emergency services levy (ESL) continues to cause client concerns. This decision is just four weeks away from when the previously proposed changes were due to take place. So where do you stand now?

READ MORE -

29/08/2017

What is WSIB Accident Assist?

We know how important your car is to you, and a car accident, no matter how minor, can be a stressful experience and a huge inconvenience. WSIB Accident Assist can help you to ensure that in the unfortunate event of an accident, we will help to put you back in the road as soon as possible with a like for like vehicle during the repair process – with no upfront costs! So how does this work?

READ MORE -

29/08/2017

Introducing Saunders Safety & Training

Warren Saunders Insurance Brokers are very excited to announce the launch of our new national safety and training division Saunders Safety & Training (SS&T). The drive to develop this division was the growing need from our clients for an onsite WHS Safety service that worked with a business to develop appropriate safety systems. Regulations now mean business owners, managers, and team members are all at risk of prosecution if there is a workplace accident. An appropriate WHS system is essential to protect you and your business. In SS&T, we have developed a team of WHS Specialists that have tremendous knowledge and experience with workplace safety systems and injury prevention.

READ MORE -

29/08/2017

Highest Fine Under OHS Laws Handed down

Does your management liability policy have sufficient cover? Do you have a decent limit? It’s not enough for employers to just have an awareness of the risks that employees face, nor simply put systems in place to manage them. Appropriate enforcement of such systems is essential.

READ MORE -

24/04/2017

Exciting Changes to Financial Services

Warren Saunders Insurance Brokers Pty Limited are very proud to announce that our Financial Services division have joined forces with locally based financial services business, Tempus Wealth. This new partnership will create a stronger and more expanded range of financial services solutions for our clients.

READ MORE

HOW WE CAN HELP YOU

Ensure you have the RIGHT protection

Insurance can be complicated, but we love it! Working with you, we’ll assess your needs and match the best Insurance solution for a practical outcome.

Claims Team

With our in-house claims advocacy team, we are with you every step of the way.

Save you money

In one meeting we saved a new client’s premium by over 1/3! We’ll show you how to make Insurance work for you.

Complete Support Service

You can contact us anytime day or night.

Knowledge brings Options

We translate the details so you understand your options